Context

SmartMEi, a startup founded five years ago, helps micro-entrepreneurs (MEIs) manage accounting and finances. It has processed over 3.3 million payments for more than 365,000 contractors across 4,700 Brazilian cities, with Rappi as its primary client.

Scenario:

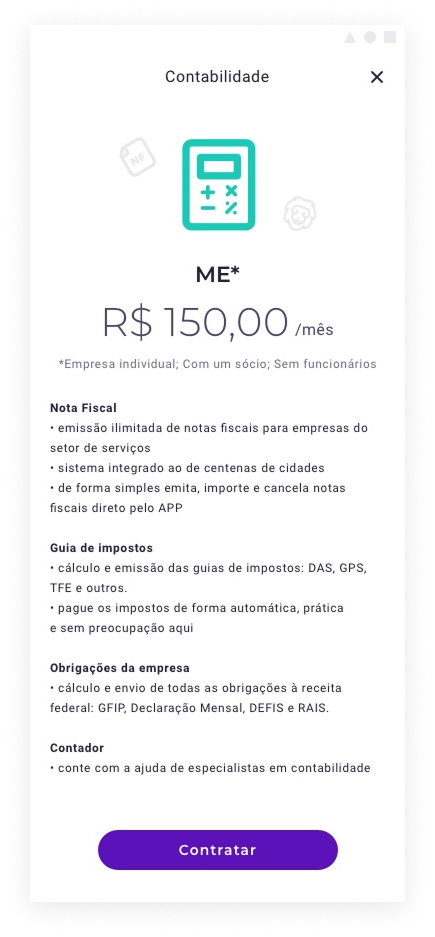

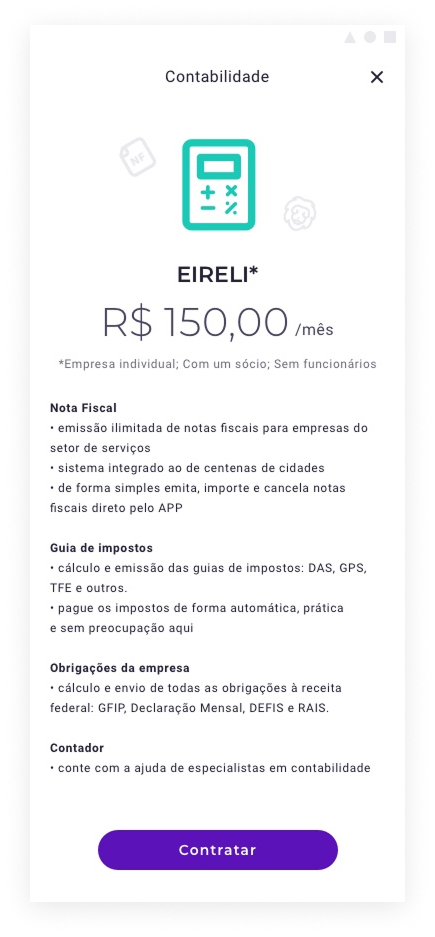

SmartMEi identified growth potential in serving SMBs (up to 50 employees) and other contractor types (ME, EIRELI), given the rise of small businesses and increasing contractor hiring in Brazil.

Conclusion:

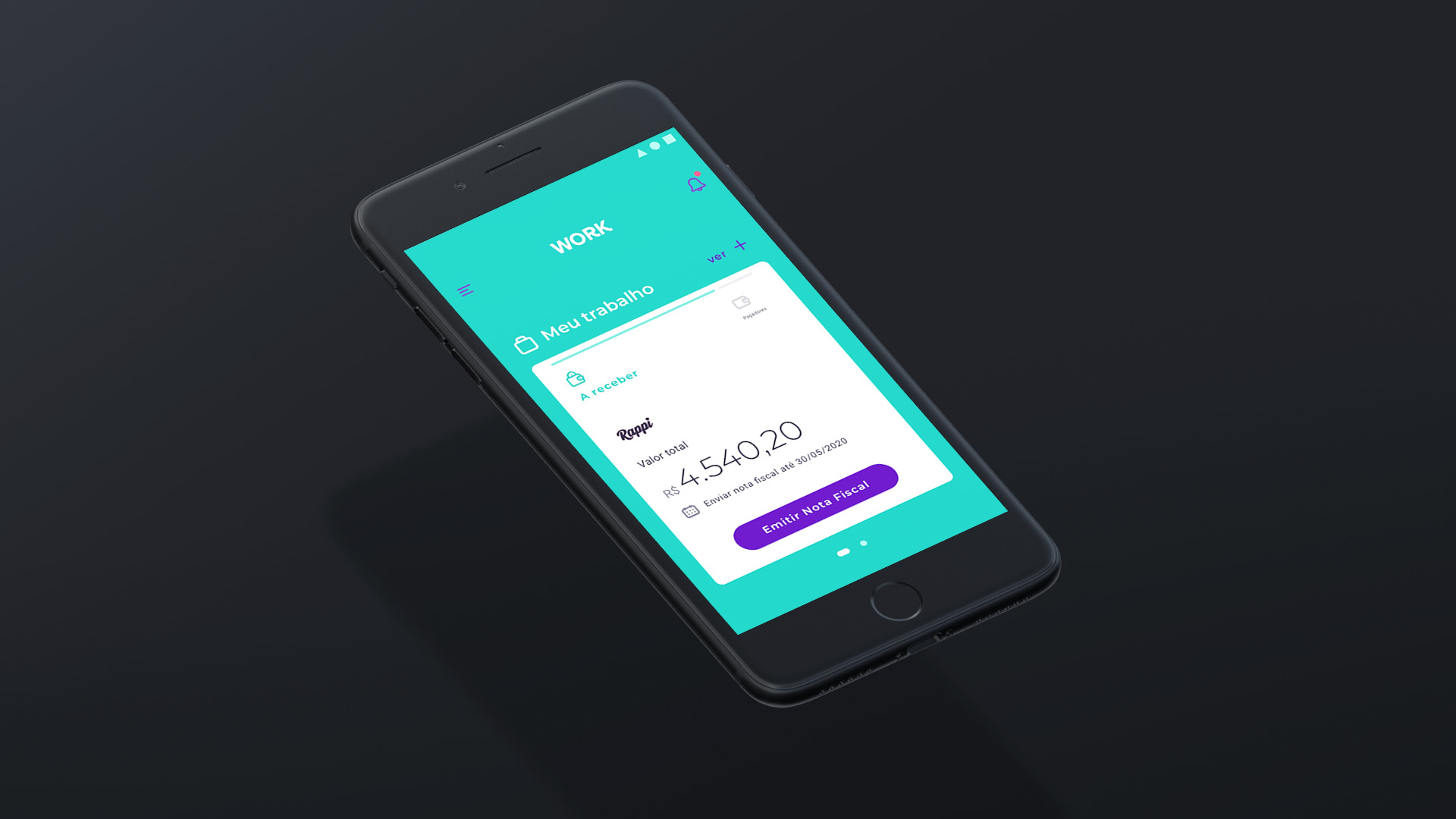

To expand beyond MEIs, SmartMEi created a new company, WORK, targeting SMBs and contractors.

My Challenge as Product Designer:

Design the digital products for WORK.

Goal

Simplify contractors’ accounting tasks.

Solution

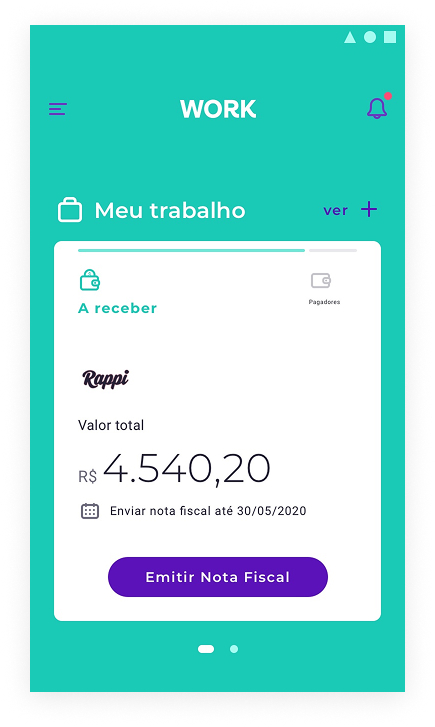

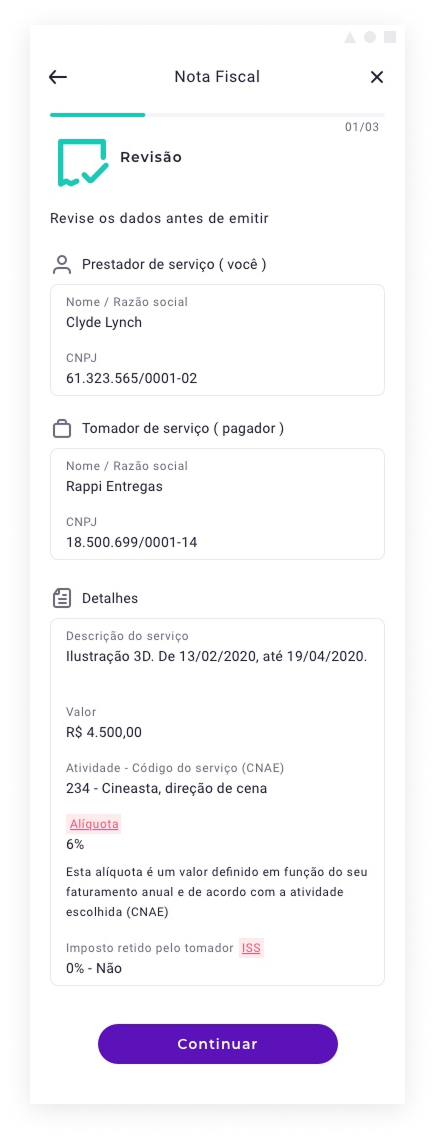

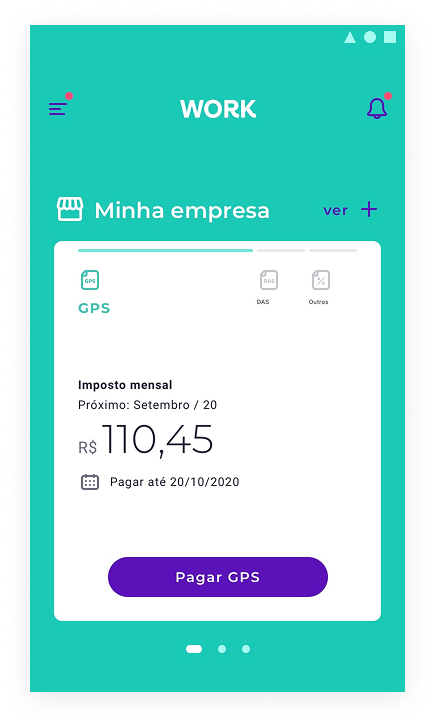

We designed WORK’s digital products in three parts:

1. SMB back-office platform: manage payments, contractors, benefits, and service bills

2. Contractor app: receive payments, send invoices, manage taxes, and access benefits

3. Accountant platform: oversee contractors’ accounting

Accounting

This case tells the story of designing WORK’s accounting solution for contractors.

Method | Discovery

Using the Double Diamond method, we began the investigation phase with research techniques to understand accounting needs and issues.

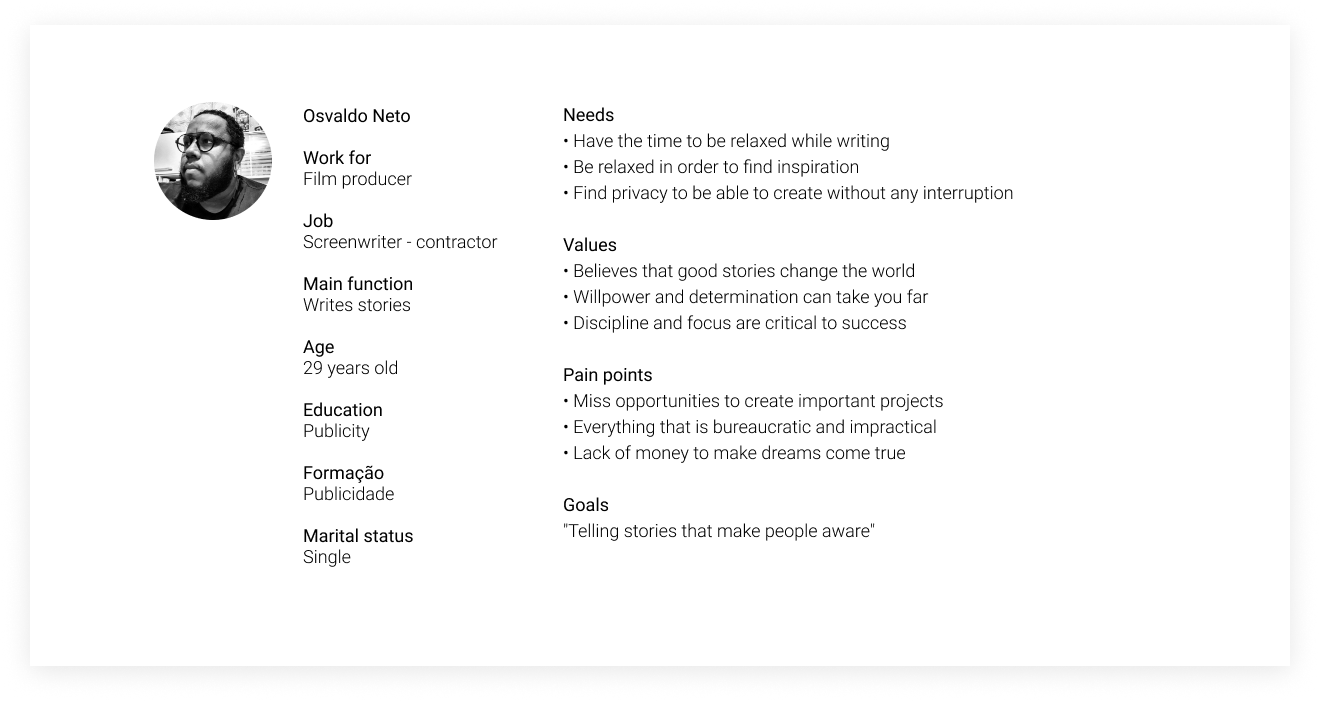

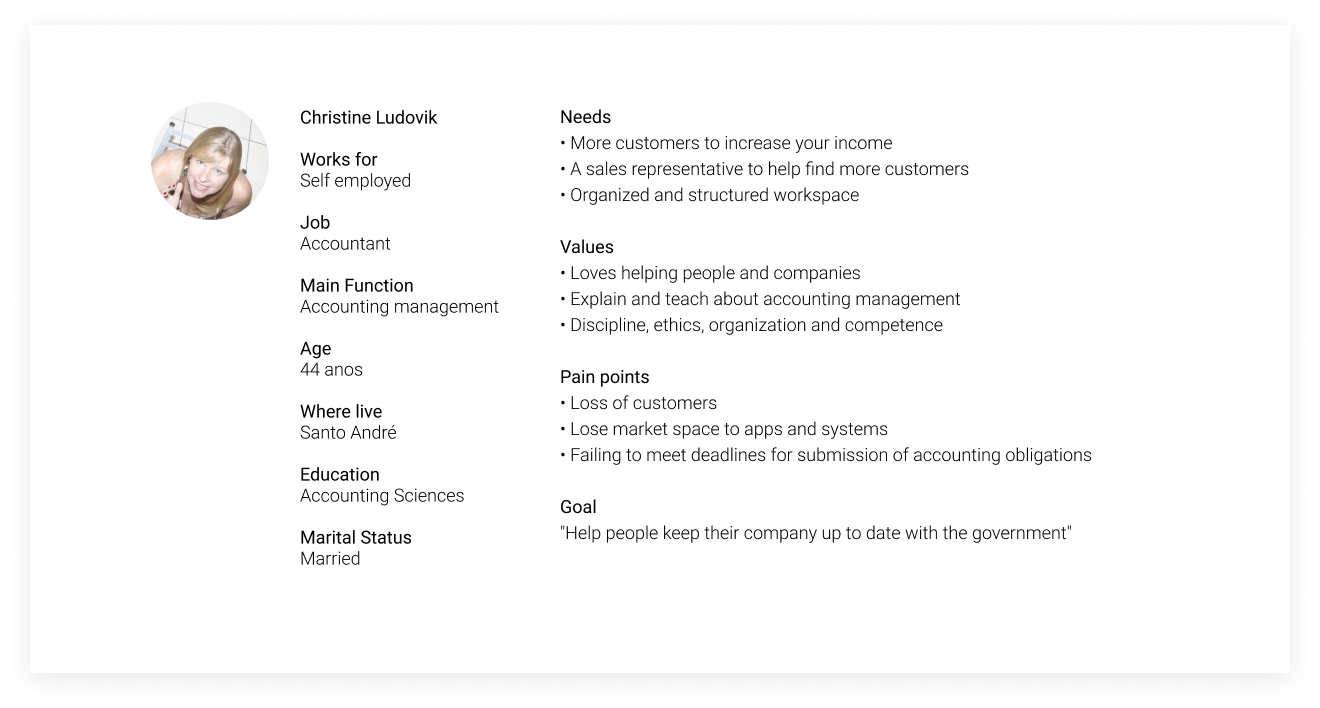

Proto-Persona

Contractors manage their own companies to comply with regulations, while accountants handle their bookkeeping needs.

CAQ Matrix

We applied a CAQ matrix to define accounting certainties, assumptions, and questions.

Certainties:

• Contractor ME has different taxes than MEI

• Every contractor ME must have an accountant

Assumptions:

• Taxes are the same across all regions in Brazil

• There may be additional taxes

• No free accounting service exists for ME

Questions:

• How do accountants settle taxes for contractor ME?

• How do accountants handle ME obligations?

• How is pro-labor (partner salary) configured?

• Are there other ME taxes we don’t know about?

UX Research | Interview with the contractor

Goal:

Understand how contractors manage accounting.

Interviewee profile:

Individual legal entities (ME or EIRELI) without partners or employees, working as service providers

Benefiting areas:

• Accounting and benefits sector

• Contractors as end-users

Expected result:

Increase user adherence and retention

Number of interviews: 7

Google Sheets - Tab:

Miro - Tab:

Interview Script (summary):

1. How do you handle your company’s accounting (app or accountant)?

2. How much do you pay for the service?

3. When do you contact the service, and when do they contact you?

4. How often do you use it (daily, weekly, monthly, yearly)?

5. Which accounting services do you use most?

6. What taxes do you pay and how often?

7. How do you receive and pay these taxes?

8. How do you access historical documents or declarations?

9. What do you expect from an accounting system?

10. What do you dislike about your current service, and how would you improve it?

Contractor interview insights, organized by themes:

Affinity:

"Learning tax laws is boring."

"Contractors pay accountants to avoid bureaucracy."

"Desire for accountants to handle everything due to lack of organization."

Customer Service / Attention:

"Delays in response (up to 5 business days)"

"Lack of proactive or even requested follow-up"

Communication:

"Systems not intuitive or self-explanatory"

"Poorly designed interfaces led to input errors."

Service quality:

"The online accounting service was unsatisfactory."

"Periods of inactivity or lack of service"

"Attractive-looking sites that didn't function properly"

"Hardworking accountants hindered by system failures (e.g., INSS)"

"General disorganization"

Price

"Accounting services are seen as expensive or hard to maintain."

"Prices ranged from BRL 150 to BRL 600/month, or tied to minimum wage + extra fees."

"Cost is the main pain point for many contractors."

Bureaucracy

"Lack of centralized organization for accounting information."

"Taxes like DAS and rent can't be automated, frustrating users."

"Strong desire for more automation in accounting systems."

Payment

"Need for clear, step-by-step guidance on payments."

"Desire for a banking-like experience: track all income/outcome easily."

"Simpler payment methods (e.g., automatic debit, Netflix-style)."

"Automatic notifications for upcoming tax deadlines."

UX Research | Interview with accountants

Goal:

Understand how accounting works for contractors (ME and EIRELI)

Interviewee profile:

Accountants

Benefiting areas:

• Accounting and benefits sector

• Contractors as end-users

Expected result:

Improved user adherence and retention

Interviews conducted: 6

Questions in the script:

1. How is retirement (pension) taxation offered for contractor ME?

2. What percentage of contractor MEs choose the minimum pro-labor payment?

3. What percentage chooses the pro-labor ceiling?

4. Do some contractors opt for a midway contribution between minimum and ceiling?

5. Is “dividend” a common term used when explaining GPS collection setup to contractors (ME or EIRELI)?

Miro - Tab:

Accountant interview feedback (summary):

• Gathered insights on how accountants handle contractor ME and EIRELI taxation

• Explored pro-labor payment choices (minimum, ceiling, midway)

• Identified terminology and practices, such as using “dividend” when explaining GPS contributions

• Findings helped clarify accounting processes and contractor needs

Goal | Keep in mind

Simplify contractors’ accounting tasks.

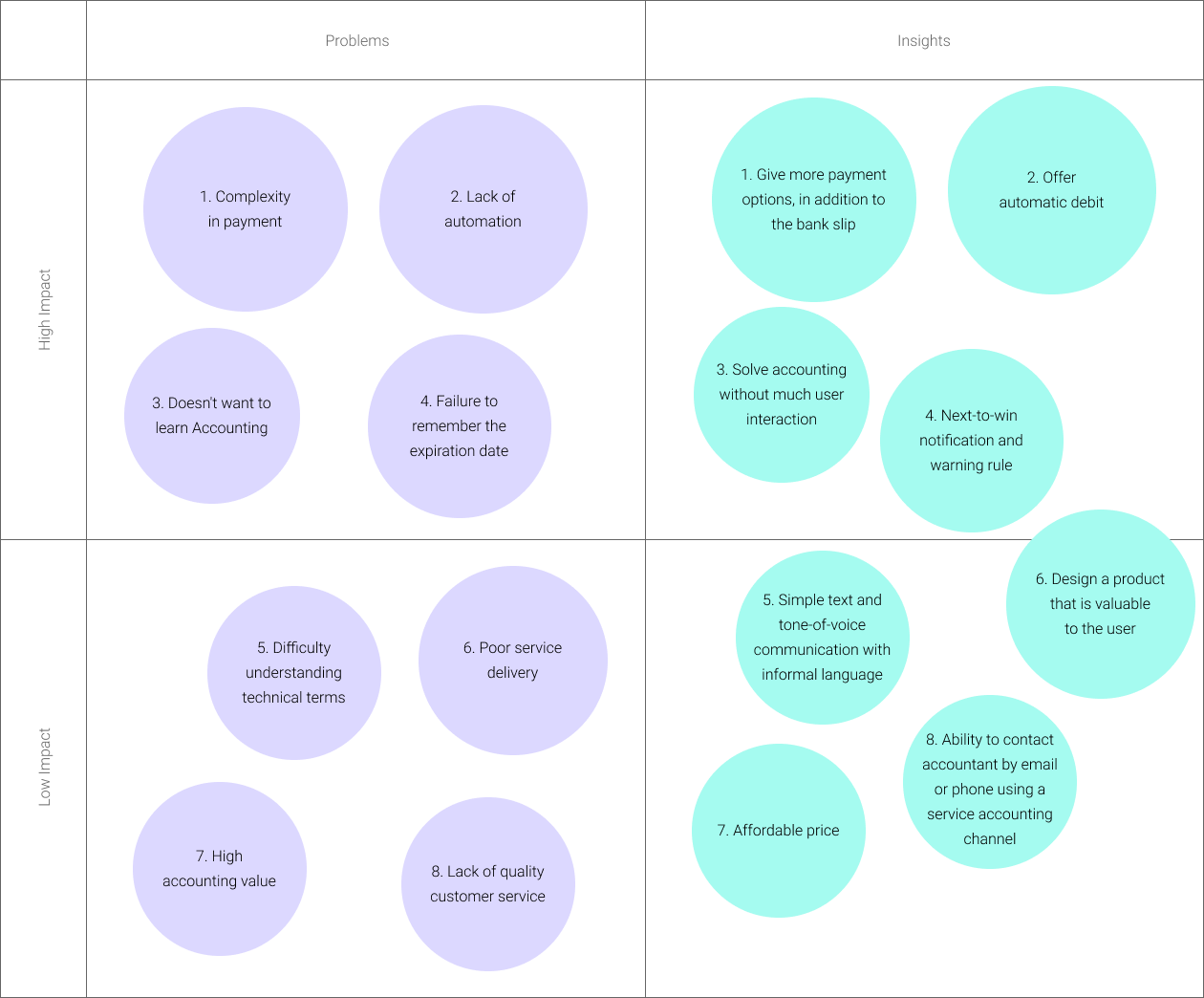

Problems | Insights

• Organized problems and insights in a prioritization matrix

• Product Head/CEO and designers prioritized solutions with the greatest business impact

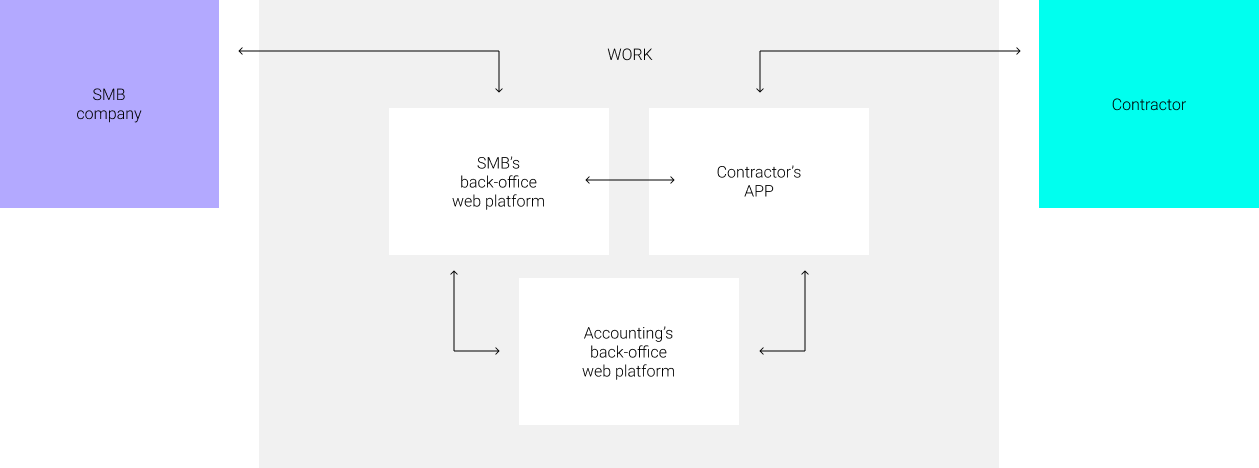

Mapping

By mapping the SMB–contractor–accountant relationship, we defined WORK’s role:

• SMB back-office platform: request and approve/decline contractor invoices for payment

• Contractor app: send invoices, manage taxes, and handle government obligations

• Accountant platform: manage contractor accounting and provide a communication channel with contractors

Method | Co-creation

Used co-creation to:

• Gather quick feedback

• Align with stakeholders

• Explore alternative solutions

• Foster collaboration and ownership

• Build a more complete product

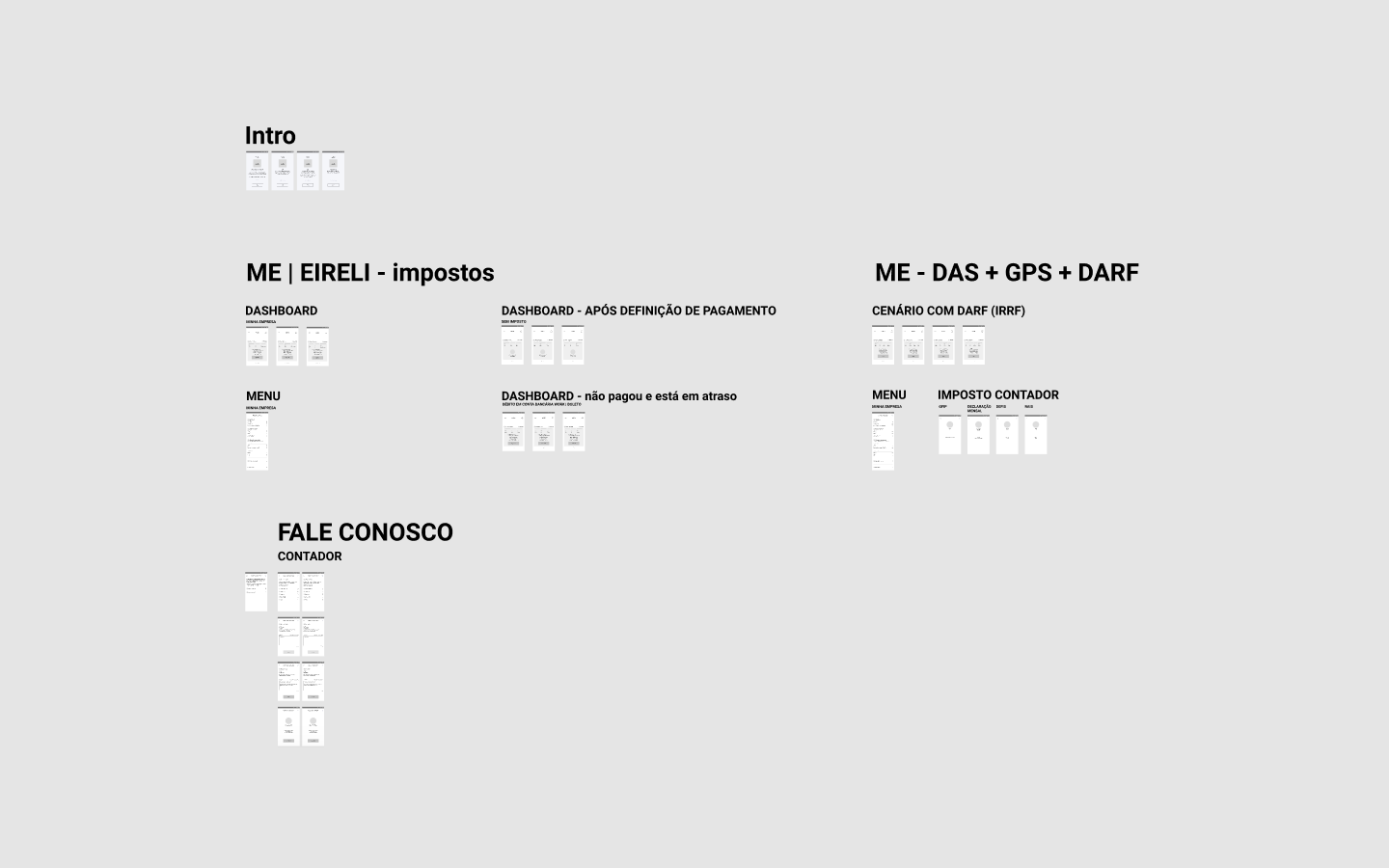

Wireframe

Drafting paper and wireframes was crucial in clarifying scenarios, flows, and content structure. Conversations with the Head of Products deepened my understanding of complex business needs and provided valuable feedback for improvements.

Latest wireframe:

Medium fidelity in Figma

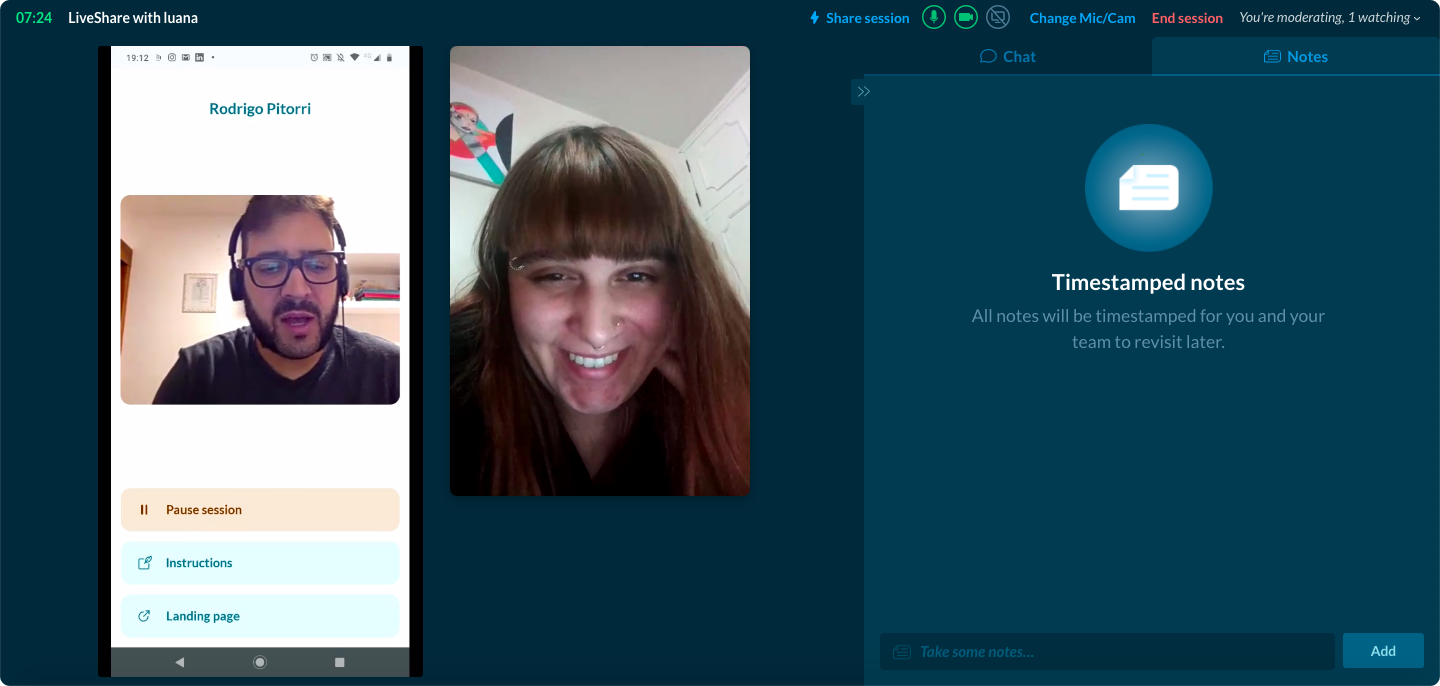

Prototype

The prototype validated navigation and interaction.

1. WORK Accounting:

In medium fidelity using the Marvel App.

UX Research | Usability Test

Qualitative usability survey for Accounting WORK:

Goal: Remote, moderated

Format: Marvel App, Lookback, Google Meet, Docs, Sheets

Tools: Individual legal entities (ME or EIRELI) without employees/partners

Tests: 5 sessions

Beneficiaries: Accounting sector, contractors as end-users

Expected result: Positive satisfaction rate

Script - Google Docs:

Test result

Problems identified:

• Confusion about setting up automatic debit for taxes

• The accountant handles the lack of clarity regarding annual/monthly obligations

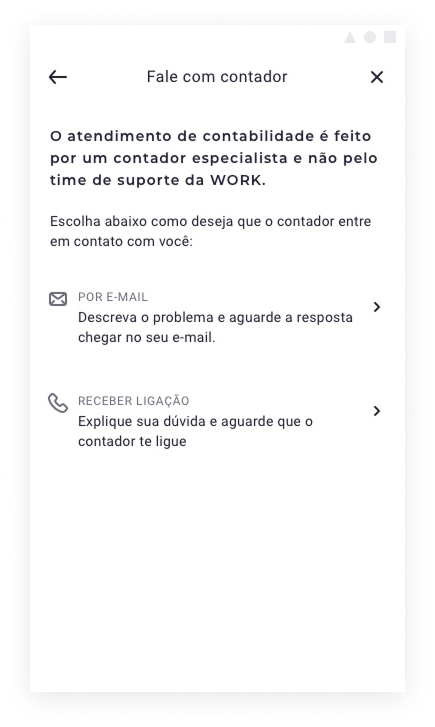

• Unawareness of a direct communication channel with the accountant

• Satisfaction rate: All users were satisfied

User feedback highlights:

• Clear information and simple language made accounting easier

• Automation of payments is highly valued, saving time and effort

• Users appreciated summaries, notifications, and proactive features

• Many described the platform as simple, intuitive, and the easiest accounting experience they’d had

Google Docs - Completed script (example):

Google Sheets - Test Tab:

Insights from surveys

1. Contractor interviews: Contractors don’t want to deal with accounting and prefer full automation (data entry, payments, automatic debit).

2. Competitor product users: Suggested adding default system values when contractors leave fields empty.

3. Accountant interviews: Custom pro-labor configurations are uncommon.

4. Usability tests (ME/EIRELI contractors): Strong demand for maximum automation and minimal contractor involvement.

User quotes highlight:

“I’d pay triple for everything to be automated… automation is really cool.”

Take away / What I learned

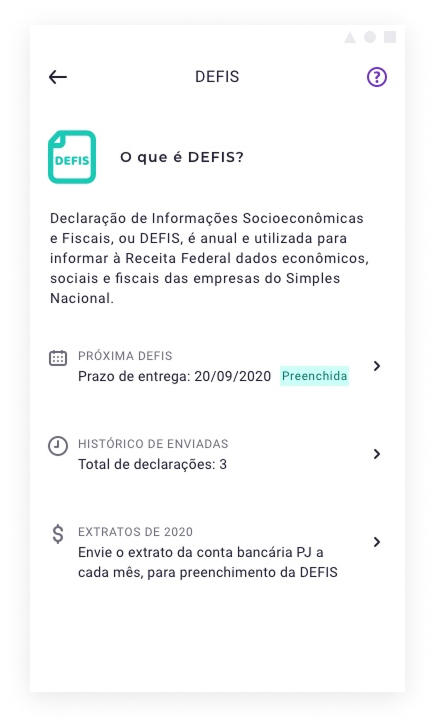

1. Annual statement of the contractor ME

Before the research:

The Product Head/CEO hypothesized replicating SmartMEi’s MEI annual statement feature for contractor MEs, where users manually fill in their yearly accounting statement and submit it to the government.

Earlier medium-fidelity wireframe created in Figma:

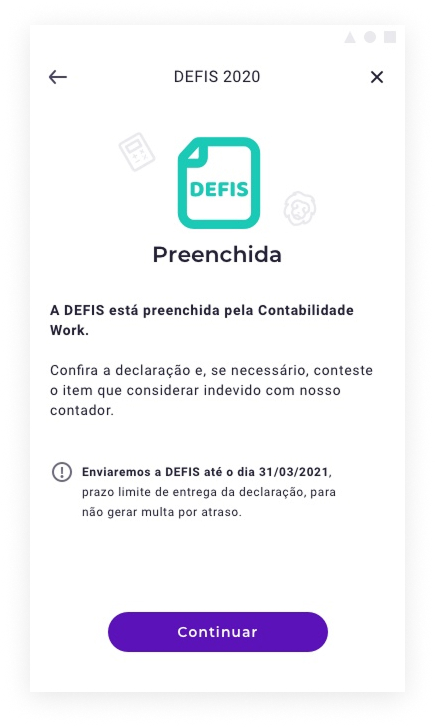

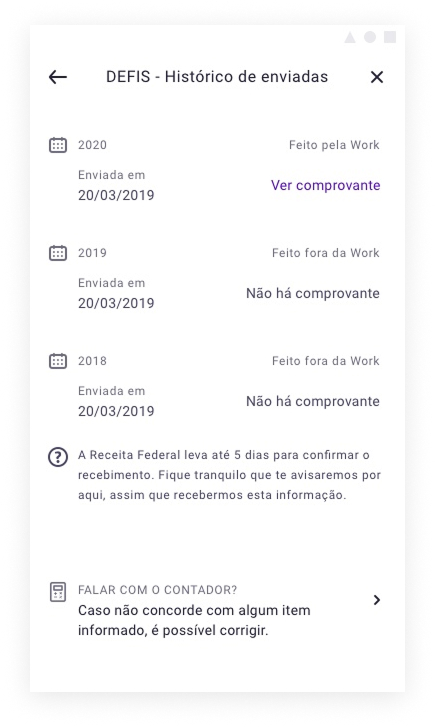

After the research:

Survey results showed the best approach was to have the WORK accountant partner complete the ME annual declaration, minimizing contractor involvement. Contractors would review the statement before submission, request changes if needed, and could still make edits through the accountant even after submitting it to the government

Final medium-fidelity wireframe created in Figma:

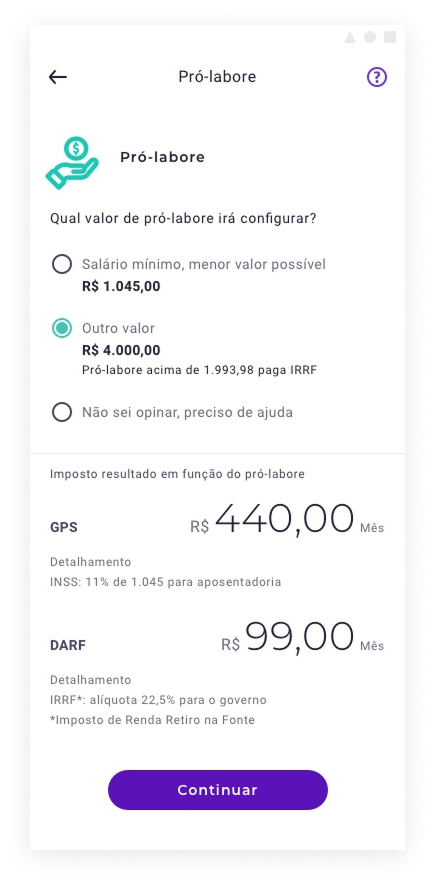

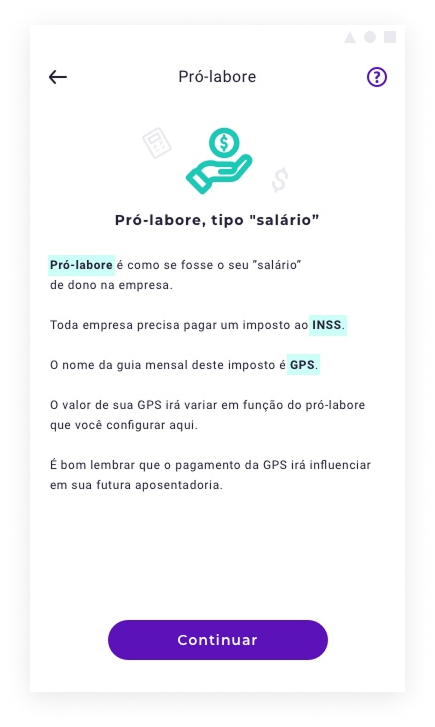

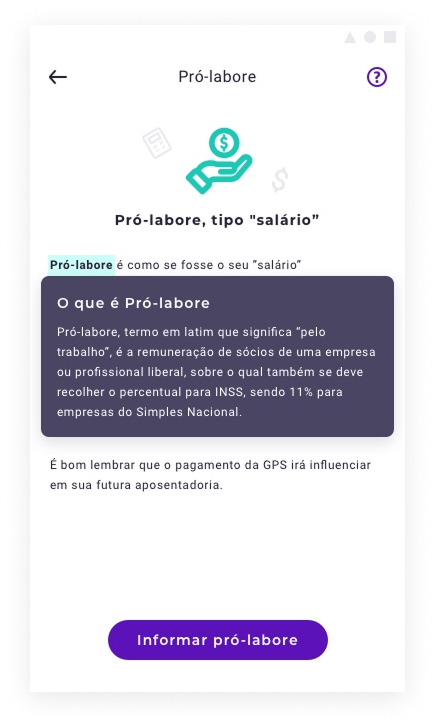

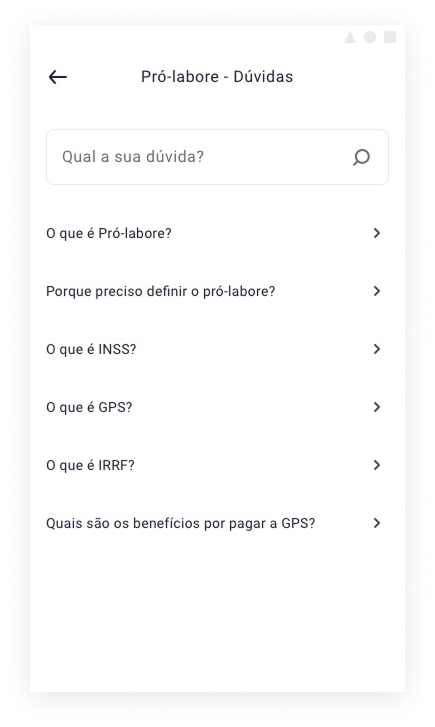

2. Contractor ME Pro-labor Configuration

Before the research:

The product team hypothesized that contractors would set their own pro-labor value, which would then determine the GPS (Government Pension and Social Security) tax amount for retirement.

Earlier medium-fidelity wireframe designed in Figma:

After the research:

The best approach was to set the pro-labor value, pre-configured by default, to the minimum salary, with the option for users to adjust it based on their profile. This kept WORK Accounting automated while requiring minimal intervention from contractors.

Final medium-fidelity wireframe created in Figma:

Goal | Keep in mind

Simplify contractors’ accounting tasks.

UI Design

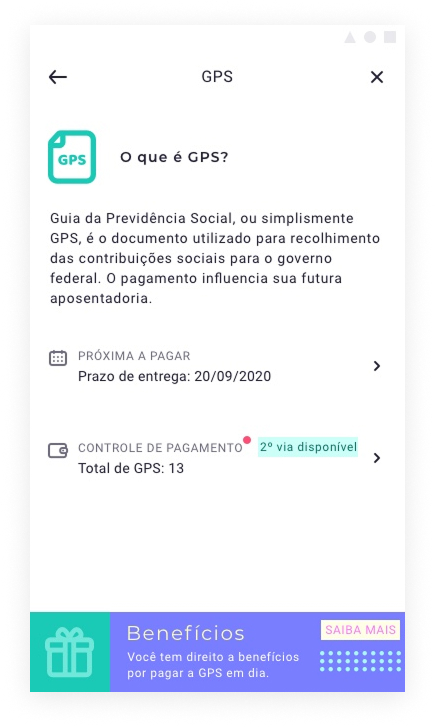

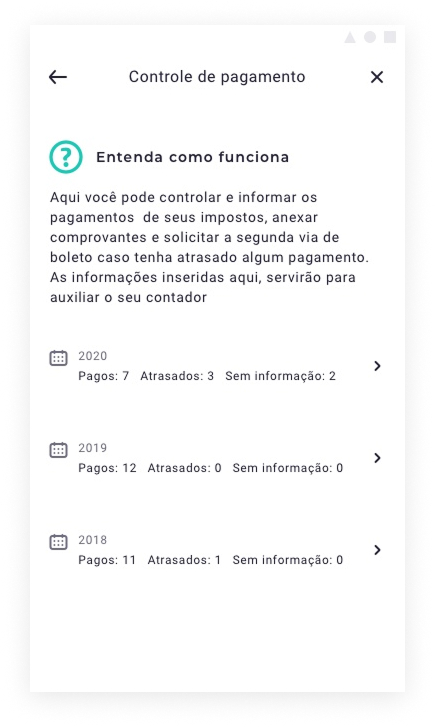

High fidelity screens

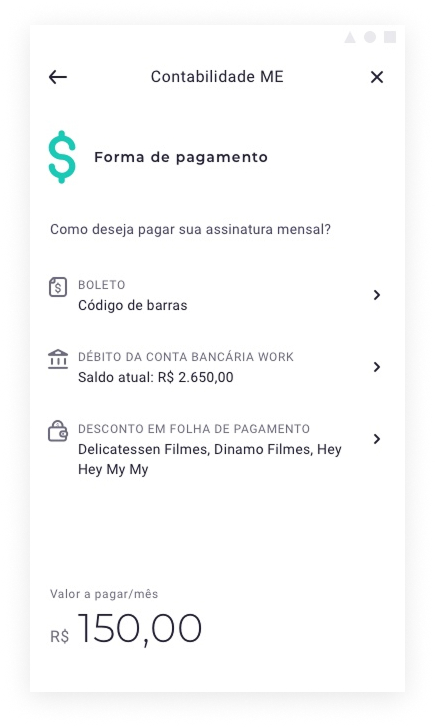

Problem:

Payment complexity

Assumption / Possible solution:

Provide multiple payment options beyond bank slips

Problem:

Contractors don’t want to learn accounting

Assumption / Possible solution:

Handle accounting tasks with minimal contractor involvement

Problem:

Contractors forget tax due dates

Assumption / Possible solution:

Send app notifications and email alerts as deadlines approach

Problem:

Contractors struggle with accounting jargon

Assumption / Possible solution:

Use clear, simple, and informal language for communication

Problem:

Accounting services are too expensive

Assumption / Possible solution:

Offer more affordable pricing

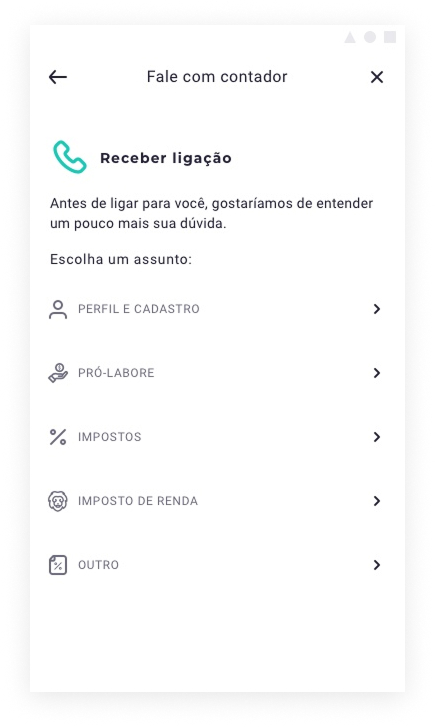

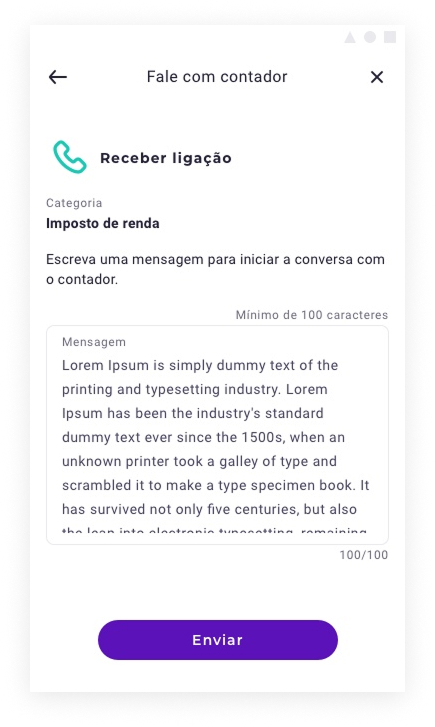

Problem:

Poor customer service quality

Assumption / Possible solution:

Provide a dedicated accounting service channel with email and phone support

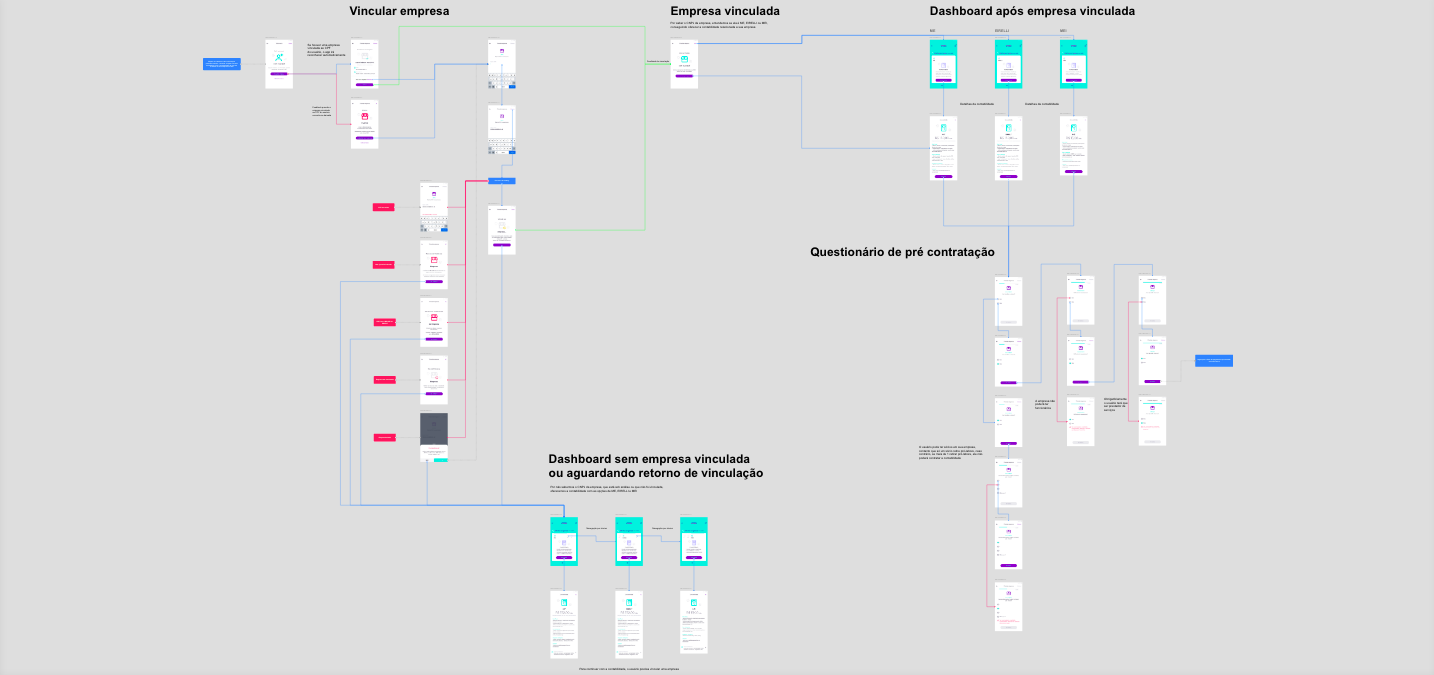

User Map Flow

• UI screen documentation for stakeholders

• Browsable flows organized by sessions

• Usage scenarios: normal, success, back, and error

• Developer notes with business and product rules